The State bank of India (SBI) is an online banking facility started by the bank with an objective to help individual entrepreneur or small business owners meet their budget expectations. Today here in this article, we will provide you all the information related to SBI Saral Net banking, State bank of India Saral Corporate Internet Banking CINB 2022 at https://corp.onlinesbi.com/corporate/sbi/corp_saral_banner.html (or) https://yonobusiness.sbi/login/yonobusinesslogin. So read this article from beginning to end

Table of Contents

Details of SBI Saral

| Name of the portal | Saral online banking |

| Launched by | State Bank of India |

| Objective | To help business people meet their budget |

| Category | Article |

| Official Website | https://yonobusiness.sbi/login/yonobusinesslogin |

SBI Saral Net banking Portal

The SBI Saral Net banking provides facilities for the user to get a variety of services online from anywhere, anytime, without visit the bank. The State Bank of India Saral is the best online banking service that let their customers to make transactions upto Rs 5 lakh per day.

The SBI bank offers various corporate internet banking services CINB services that is available to each person based on their business or income. The current account holder or corporate customer has many business activities that generate revenues. This might include Partnerships, trust, or organizations; the Saral account is one among the seven types of CINB accounts. This platform is directly limited to a single user or business.

SBI Saral account – Services available

The following services are available on the SBI Saral Account

- Merchant transactions.

- Have schedule transactions.

- Transaction right (receive and transfer money)

- Users can download and view their account statements.

- Saral account has defined limits for all beneficiaries

- Standing instructions

- Merchants payments

- Authorized bill payments through Saral online banking account.

- Users can request for a DD subject to their day’s limit.

- Saral account holder will be able to pay tax (CBDT) direct tax and the indirect tax (CBEC customs)

- The state government tax.

- Customers can also pay for their EPF account directly from the Saral account.

- Payment of bills such as suppliers.

- Users can apply for IPO using the ASBA.

- Participate in the e-auction.

Types of transactions on SBI Saral Account

On the SBI Saral Account, you can perform two types of transactions

Intra Bank payments

Transfer between SBI accounts each day.

Inter Bank payments

Transfer between SBI accounts to other bank accounts each day.

Important Note: The Saral SBI account let’s users to make transaction about Rs. 50,000/- per day with the SBI bank or other banks.

New users can make use of the Saral CINB by simply downloading the application form from the official website of the SBI. After filling the form, they have to submit it to the nearest SBI bank branch.

How to Login to the SBI Saral Corporate Service?

For accessing the CINB services, you have to first register as active internet banking users, follow these steps below

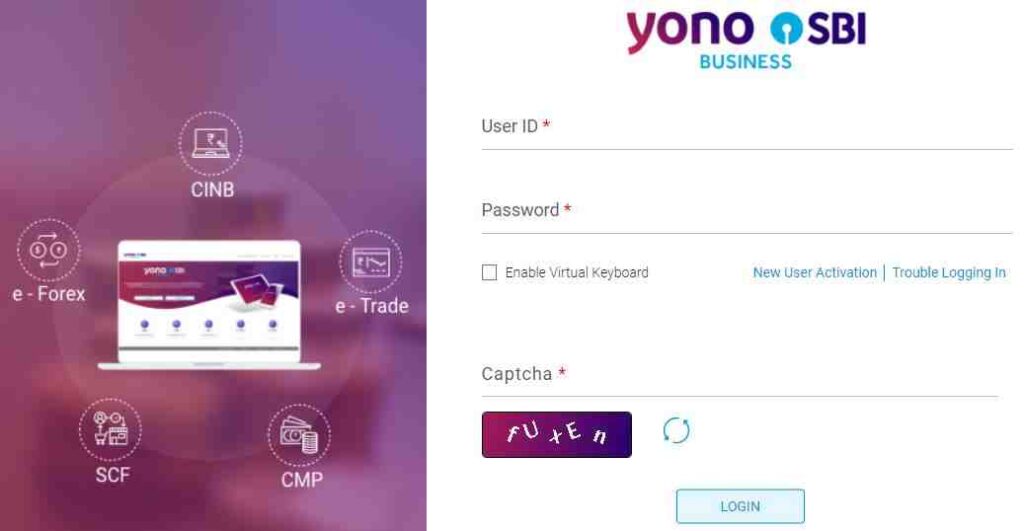

- First of all, go the official website of SBI Saral Portal at https://yonobusiness.sbi/login/yonobusinesslogin (or) https://corp.onlinesbi.com

- Once the home page of the website open, Login to the portal by entering your banking id and password.

- After this, click on the manage beneficiary option available on the profile tab.

- In the next step, click on the state bank group beneficiary tab and then hit the add button.

- For registering the SBI Saral Corporate Service, you are required to enter beneficiary details such as:

- Name

- Beneficiary account

- Account number

- The beneficiary bank and address.

- To total amount to transfer or the transfer limit.

- Note you can fill the beneficiary IFSC code by clicking of the IFSC code tab from the page enters the 11-digit code for the beneficiary’s bank.

- In case, if you dont know the code, choose the location option, after which you will see the beneficiary’s name, location, and branch.

- After filling these thing, click on the submit button and then the IFSC code will be displayed on the screen.

- Now, you will be shown the terms and conditions page where you have select the checkbox and agree

- Once you are done with the above step, you will see the submit button, click on it.

- After this, the system will add the beneficiary to the account automatically.

OTP Process

- Now, you will get an OTP on your registered mobile number for validation, enter this OTP in the given space and confirm.

- You will now be able to do payments to the beneficiary account by clicking the inter-banking and filling the state bank group transfer to proceed.

- From the list of beneficiaries, select one you wish to transfer money to and enter the amount and remarks for the transaction.

- The portal let’s Saral users to do payments on the current date or schedule dates.

- Although the transaction cannot be scheduled for more than 90 days from the current date.

- Also, the portal works on all bank working days ie: users who schedule the payment on the holiday will get processed on the next working day.

- In the last step, confirm all the details once and then hit the submit button to complete the process.

Also Read: Bank of Baroda Net Banking Registration Activation, login at Bobibanking.com

We hope, you are provided with all the information related to SBI Saral Net banking. If you find this article beneficial then show your support by bookmarking our website. Also post your queries related to SBI Saral online banking in the comment.