The LIC Insurance Corporation ensures that policyholders have access to the best and most beneficial insurance products available. In India, the LIC is a well-known insurance provider that has a huge number of policyholders.

Interested persons who would like to avail policy from LIC must check on insurance terms like maturity value, sum assured policy term, and more. Life insurance, for example, pays in the case of the death, disability, or fatal accidents of the policyholder. The majority of policyholders are only interested in the benefits mentioned above, not the maturity value. It’s a good idea to ask about your chosen policy’s maturity value.

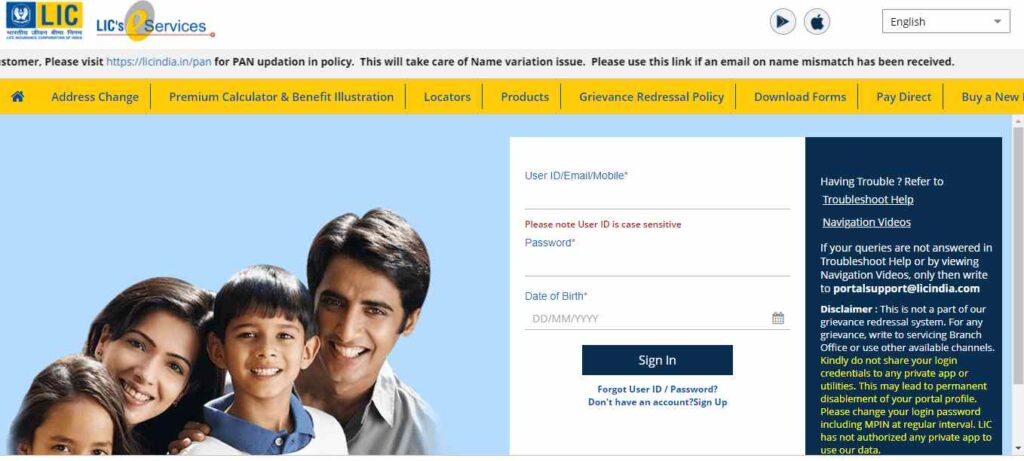

So today in this article, we will provide you information on how to Check & Calculate LIC Policy Maturity Amount in a step-by-step procedure.

Table of Contents

LIC Policy Maturity Amount

The sum offered by the Insurance Company once the policy achieves maturity is known as a maturity benefit. The sum is a bonus for the number of years or terms you’ve invested in the policy. The Corporation should pay the specified premiums plus the bonus for the policy term. It’s worth noting that the maturity bonus is only available if the policyholder pays their premiums on time. If the policyholder dies before the term is completed, the maturity applies. The maturity payment will be made to the eligible beneficiary.

The LIC insurance users will be able to calculate this maturity amount via LIC calculator or excel page. Before investing in any LIC policy, customers can use the LIC calculator to look up the policy and maturity benefits. Some LIC plans provide a maturity bonus, while others just have a sum assured benefit.

LIC policies Maturity Value

The sum assured and term of an insurance policy are determined by the applicant’s age. The policyholder is responsible for paying the premiums on time, whether through online or offline methods. The following are the components of the LIC maturity value with profits:

- Sum assured

- Bonus achieved during the policy term.

- Another final additional bonus.

The benefits, however, are payable if the policyholder dies before the term expires. A bonus equivalent to the sum assured will be given to the beneficiary/nominee. If the insured passes away before the end of the policy term, the nominee will receive the sum assured, as well as any final additional benefits and vested bonuses that were in effect at the time of death. A final additional bonus is a payment made to the policyholder after the policy has reached its expiration date.

How to Check LIC Policy Maturity Amount?

By providing a rough estimate of these details given below, the LIC users can calculate the maturity value.

Sum assured +bonus + final additional bonus

The user must use the LIC calculator to calculate the LIC maturity value. Fill in the following information to complete the process.

Policy sum assured

The sum assured is an important figure in determining the maturity value.

Policy plan

LIC Corporation offers a wide range of plans to its customers. Your maturity value is also determined by the policy you choose. To acquire the benefits and precise calculations, enter the name of your policy while calculating.

Policy term

On the LIC calculator, ensure to enter the policy term to calculate the maturity value.

Contact details, date of birth, and name

When calculating the value, contact information is very important. On the calculator, enter the applicant’s name, date of birth, registered mobile number, and other information.

Click “Calculate Maturity” after double-checking the information on the LIC calculator. The system will process the input and provide a LIC Policy Maturity Amount based on it.

Also Read: How to Check the LIC Policy Status Without Registration at www.licindia.in

FAQs

Which policies have the maturity value?

Many LIC policies come with a maturity value from the LIC Corporation. Maturity value is available to users with life insurance policies, children’s policies, single premium plans, and more.

We hope this article has helped you with information on how to check LIC Policy Maturity Amount using LIC Maturity calculator. See you in the next article.