EPF Withdrawal Online: The government and your employer encourage you to save small amounts of money, which in turn turns into a big amount that can serve as your retirement fund. With the new EPF calculation, the EPFO department takes 12 percent of the salary out of the entire work life of all salaried employees and gives it back to them during their retirement as a large corpus of money.

Along with your 12 %, your employee also adds a small percentage from their side to your retirement fund every month. It is not compulsory that you can withdraw your PF funds only after your retirement but you can also withdraw your funds anytime for different reasons.

Table of Contents

EPF Withdrawal

The very first step you have to do is activate your UAN number to withdraw your money from the EPFO portal. You can find your UAN number on your salary slip and after activating the UAN number you have to complete the KYC process.

EPF Withdrawal circumstances and Eligibility

The money in your PF account is all yours so no one will stop you from withdrawing and actually no one would stop you from doing that but there are certain government rules and criteria that you have to meet. Below mentioned are those conditions under which you are permitted to withdraw funds from the EPFO portal.

- Retirement: You can withdraw all of your funds from the PF account once your period of service is completed and you have retired from employment. However, you won’t be allowed to take any money out of your pension account.

- Transfer of PF from one employer to another: When you switch or change your jobs you also have to transfer your PF money from the old company to the new one, and many people tend to forget this. This is required because if we don’t transfer our PF money from the old company we won’t be able to withdraw it.

- Unemployed for 2 months: You may withdraw funds from your PF account in a situation where you have been unemployed for two months or longer.

- Partial PF withdrawal: For many different reasons such as education, marriage, purchase of house or land, home loan repayment, before retirement, house renovation, etc. you can withdraw your PF funds partially up to 50% to 90% in total.

How can you now withdraw money from your PF account might be the major query running through your thoughts. Well below is the entire process for how you can withdraw your money online.

EPF Withdrawal Online Process

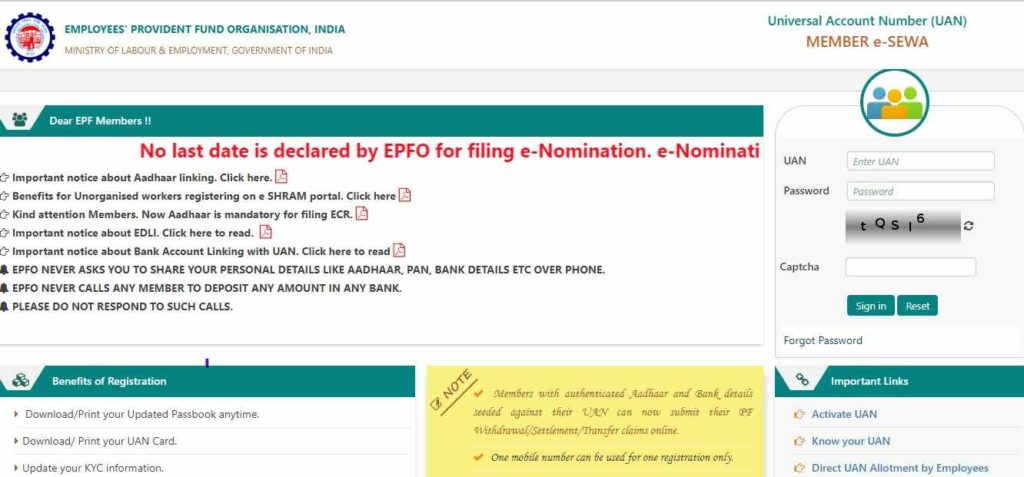

- Visit the official website of EPFO UAN – https://unifiedportal-mem.epfindia.gov.in.

- Enter your login details – UAN ID and password

- Fill the captcha, and after filling the captcha you will be able to see your UAN profile

- Click on “Online services“.

- Claim (From 31, 19 and 10C)

- In the earlier step, you will be asked to enter the last four digits of your bank account and then click verify.

- Click on “Proceed” for the online claim and an online form will show up

- Select your desired form under the ‘I want to apply’ tab.

- Select claim and enter the reason for the claim.

- Fill in the amount along with your address.

- Then click on submit to submit your claim process.

In this way, you can easily submit an online PF money claim using the EPFO portal at any time. Previously, we had to apply by filling out an offline form, which was a time-consuming and difficult process. However, it appears that the introduction of the EPF online withdrawal process has greatly helped employees across India.

Note: After submitting an EPF money claim, you will soon get the funds in your chosen bank account within 15 to 20 days; however, there are circumstances when it may take longer, such as on bank holidays or departmental holidays in the off-season.

Also Read: How to Download UAN Card Online at epfindia.gov.in

FAQ’s

Can we do EPF Withdrawal PF without a PAN number?

Yes, you can withdraw your money from your PF account without a PAN number, but you will be chargeable for the TDS deduction at a maximum marginal rate of 34%. If the amount is more than 50000, no TDS would be deducted.

What is the TAX rate for EPF withdrawal?

As mentioned earlier, there will be no tax if the amount to be withdrawn is more than 50000, and if the PAN number is not submitted then TDS up to the maximum marginal rate of 34% would be applied. In normal cases, TDS of 10% would be applied at the time of withdrawal.

How many times EPF withdrawal can be done?

The basic eligibility its employees share or the employee’s six times annual salary may be chosen. The lowest will be picked, and they will be permitted to withdraw under EPFO rules. The amount that can be taken from your EPF account is not restricted.