For state governments, the Property tax is the primary source of income for the state governments in India. Likewise, the Bangalore Property tax is the main thing in the state. Today here in this article, we will provide you information related to BBMP Property Tax, how to do BBMP Property Tax Online Payment at bbmptax.karnataka.gov.in.

Table of Contents

Overview of BBMP Property Tax

| Name | BBMP Property Tax |

| Launched by | Karnataka Tax Department |

| Objective | To pay tax payment online |

| Category | Karnataka Govt Scheme |

| Official Website | bbmptax.karnataka.gov.in |

BBMP Property Tax Online Payment 2022

Many developmental operations are funded by the levy, including maintaining state public utilities, paying government personnel, repairing and creating drainage systems, and so on. The state government of Bangalore is one of the first to digitise property taxes and develop an online payment system.

Now the citizens of Karnataka can pay their property tax with the help of an online portal started by the tax department. Bangalore property tax is collected by the city authorities from all property owners. Property owners pay the requisite payment to the Bruhat Bangalore Mahanagara Palike (BBMP), which provides them with full information regarding the value of their property and the amount due.

What is Bangalore Property Tax?

The BBMP contains a lot of information that the taxpayer should be aware of; they must comply with the authorities to avoid penalties. The BBMP examines a variety of issues in order to calculate the property value and the amount owed to each property owner. There are a number of things to look into here:

- The type of property, whether residential or commercial.

- The value of your home on an annual basis.

- Your property’s zone categorization and dimensions.

- The overall built-up area of the property and the total built-up area of each floor.

- The property’s basement and all floors

Property that may be taxed by the BBMP

- Factory buildings

- Office building and godowns

- Commercial buildings

- Flats.

- All residential property either for rent or for user residences.

How to pay BBMP Property Tax Online?

Every year, the Property owners have to pay their taxes before due dates. If you miss paying this tax, you will be charged some fine. Early payments, on the other hand, receive a 5% discount. For all property owners, the BBMP tax dates are before April 30th. They can pay using the following online method:

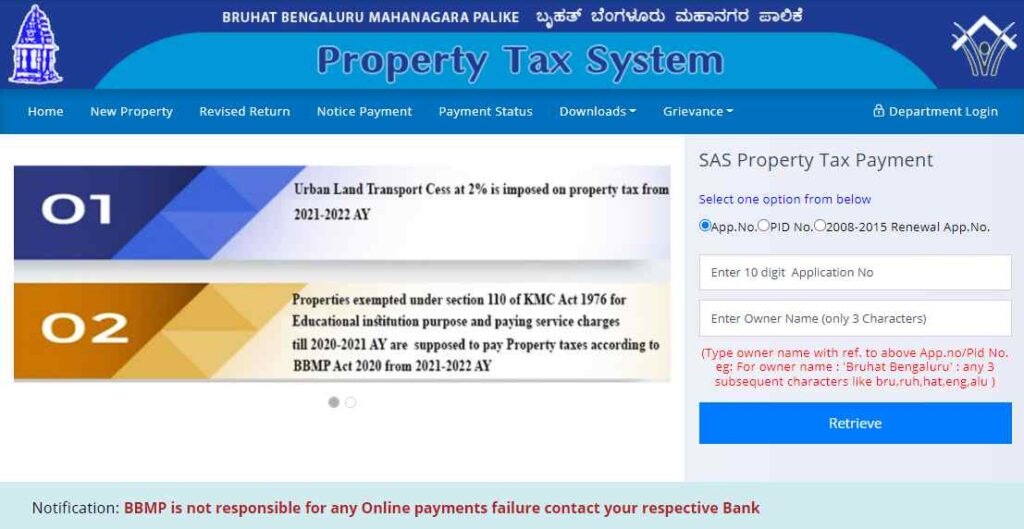

- First, visit the official website for BBMP property tax at https://bbmptax.karnataka.gov.in/ portal.

- Once you see the homepage of the website, fill in the SAS/ property identification number in the given space.

- After this, click on the “Fetch” option.

- Now, you will see your property details.

- If you don’t remember your application number, click on the “Renewal Application Number” option.

- After this, fill in your previous year application for the SAS or PID number and proceed.

- The system will provide the owner’s information based on the previous year’s information; click “Confirm” to continue.

- Fill in all essential details as per your property on a new page that appears on the screen.

- The property owner must click the “Proceed” button to make any modifications to the property’s usage, occupancy, measurements, or other associated property characteristics.

- A new page will appear, displaying form 5. Make the necessary adjustments and go to the next step.

- Before making an official payment, double-check the details. You can now use the portal’s established payment methods. Choose between paying online or depositing a challan at a BBMP office near you.

- Property owners can pay online using an e-wallet, a debit card, or a credit card, among other options.

- After payment, the system will issue a receipt; however, it may take up to 24 hours for the system to generate the receipt; it will still generate and post it on the site.

- For your convenience, you can download and print the receipt.

BBMP Timings and Due Dates

The official hours for paying property taxes in Bangalore are 9:00 a.m. to 12:30 p.m. and 3:00 p.m. to 7:00 p.m. Taxpayers can also pay their taxes at tax offices or by calling the helpline and following the instructions. Note that if you pay your tax after the due date, you will be charged a 2% penalty every month; you can also pay the tax in two instalments to avoid interest. The amount should be paid before April 30th, when the BBMP offers a 5% discount to property owners who pay on time.

BBMP property Tax Calculator

The Bangalore tax is calculated in three different ways:

Annual rental value system

The gross annual rent of the entire property and assesses tax based on the expected value.

Capital value system

The amount of tax is determined by the property’s market value.

Unite area system

The property tax is calculated based on the per-unit price of a carpet area.

BBMP Property Tax Contact Information

Property owners with issues can call the BBMP offices at the following numbers:

| [email protected] | |

| Phone number | 080-229705555 |

| Support line | 08022660000 |