Table of Contents

PAN Aadhar Link

Aadhaar card is a legal document which is provided to every citizen of the country by the Unique Identification Authority of India (UIDAI). This card has an unique 12-digit number which is used as a proof and also holds all the E-KYC details of the cardholder. The PAN card (Permanent Identification Number) is also a legal document provided to all the citizens by the Income Tax department under the central board of direct Tax CBDT. This document is useful in filing tax and used as a identity proof document. The government has imposed a rule to do PAN Aadhar Link recently.

Today here in this article, we will provide you the information on How to link Aadhaar with PAN card online in a step by step procedure, How to link PAN with Aadhar by SMS, Check PAN Aadhar link status online. So read this article completely.

PAN Aadhar Link

| Article Name | How to link Aadhaar with PAN card online |

| Objective | To link Aadhaar with PAN card |

| Category | How to |

| Official website | https://www.incometaxindiaefiling.gov.in/home |

These two cards are very important for every citizens of India as it can be used in banking activities, filling return and many different facilities. In order to make the process more efficient, the supreme court has passed an order stating that “Aadhaar card is mandatory for applying income tax returns and also for applying new PAN”. This statement leaves no option for the people applying for new PAN card have to link their Aadhar cards.

All the taxpayers across India will have to submit their Aadhar number to the Tax authority. The PAN Cards must be linked with the Aadhaar card according to the ACT 139AA (2). In this article, we will provide you the benefits of linking the cards, how to link and check the status of the link process and deadline details.

Benefits of PAN Aadhar Link (Individual)

- Income tax process gets accelerated because of linking PAN with the Aadhaar card.

- The PAN with the Aadhaar card linking will eliminate manual signature, and digital signature while filing income tax.

- The two cards are essential to the Indian citizens they act as proof documents on various occasions.

- If you want to open bank account, you dont have to provide other documents, since your Aadhaar has all E-KYC details.

- On the income tax login page, Aadhaar card is used to authenticate tax filling and check all transaction details.

Benefits for the linking PAN with the Aadhaar card (Government)

- The government can keep track on all transaction and restrict multiple PAN cards to evade tax payment.

- It will also eliminate black money.

How to link Aadhaar with PAN card online step by step procedure?

Follow these step by step procedure below to link Aadhaar with PAN card online on the income tax e-filling website

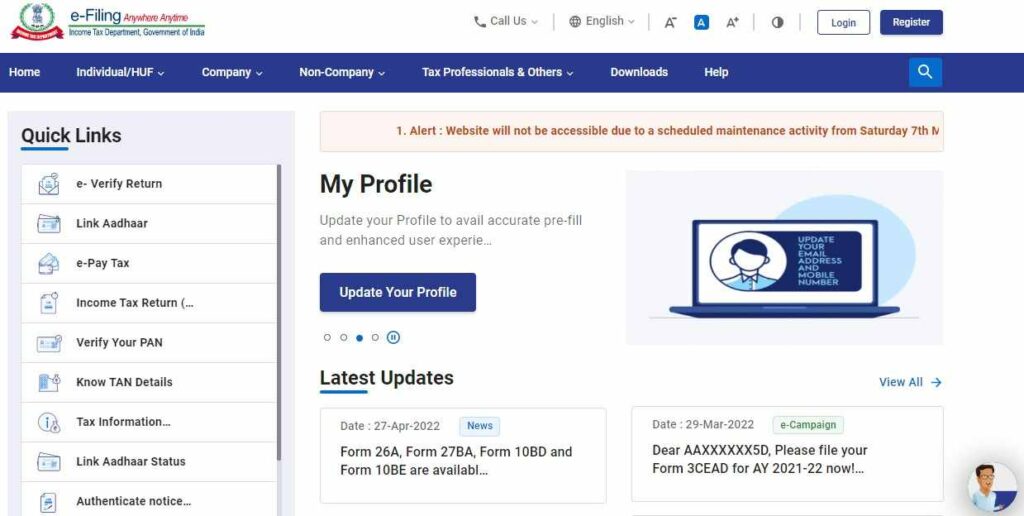

- First, go to the official website of income tax e-filling at https://www.incometaxindiaefiling.gov.in/home.

- On the home page of the website, click on the option “Aadhaar” from the “Quick links“

- After this, fill in your PAN, Aadhaar number, name as mentioned on the Aadhaar.

- Now, tick the checkbox, if your date of birth is mentioned on your Aadhaar card,

- In the next step, fill in the security code shown and then hit the “Link Aadhaar” button.

- Your Aadhaar will be successfully link with your PAN in this way.

How to do PAN Aadhar link using SMS?

You can also Link Aadhar card with PAN card through SMS, for this you have to follow these steps given below. This is for those who don’t have easy access to the internet connection.

- First of all, You have open your messenger and type UIDPAN<12-digit Aadhaar><10-digit PAN>

- Send this text message to 567678 or 56161 from your registered mobile number.

- After verification by the department, your Aadhaar will be linked with PAN card successfully.

How to Check PAN Aadhar link Status online?

To check the PAN Aadhaar link status online, you have to follow these steps below

- First of all, visit the official website at https://www.incometaxindiaefiling.gov.in/home

- Once the home page of the website open, click on the option “Link Aadhaar” under “Quick links“.

- After this, a new page will open, here you have to click on the “click here to view the status” option

- Note: The above step is only applicable if you have sent the Aadhaar link request.

- In the next step, enter all the details asked and then click on “view link Aadhaar status” option

- The system will then show whether your PAN Card is linked with Aadhaar link or not.

FAQ’s

What is the last to link PAN Aadhar link online?

The Government and the Income Tax Department has issued an deadline of 31st March 2022 to link PAN card with Aadhar card

Is there any documents that has to be submitted while doing PAN Aadhar link?

No, you don’t have to submit any documents to link the Aadhaar and PAN card online, you have just follow the above steps mentioned in this article.

Will I be able to de-link the Aadhaar card and PAN once linked?

No, you cannot de-link your PAN Card and Aadhar card once it is linked.