Friends, in this article we will be discussing the OLTAS Challan, step by step procedure on how to check the OLTAS Challan Status online in different methods. Also, we will see what is the Payment Process of OLTAS Challan and its refund status check procedure. So read this article completely.

Table of Contents

Overview of OLTAS Challan

| Topic Name | Online Tax Accounting System |

| Department | Income Tax |

| Category | Article |

| Official Website | https://tin.tin.nsdl.com/oltas/ |

What is OLTAS?

The full form of OLTAS is the Online Tax Accounting System. This allows taxpayers to pay all of their taxes, including income taxes. This may also be able to keep track of payments made through their platform, generate receipts, and pay direct taxes through their network of payment services.

The Indian Government has developed an online portal named OLTAS to assist the Income Tax Department & Tax Information Network. Suppose you have paid a direct tax via OLTAS platform recently, you should have received an acknowledgment, but no confirmation.

OLTAS Challan Status

You must verify the status of the OLTAS payment in order to understand if it was completed. The OLTAS challan isn’t just for taxpayers; it’s also for banks, as we’ll see later in this article.

How to Check OLTAS Challan Status Online?

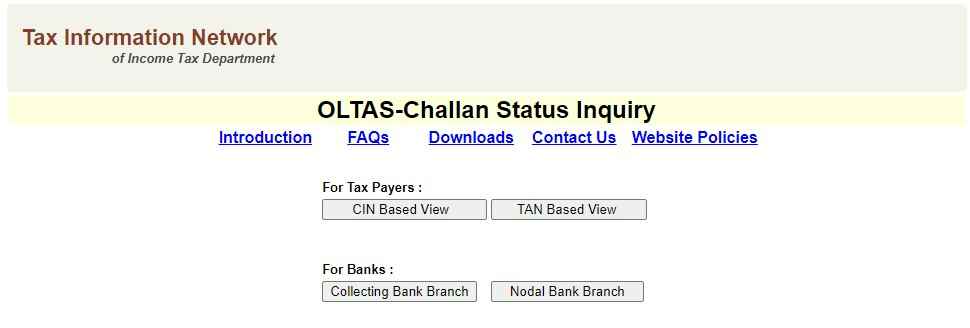

There is a separate page that has been created by the Income Tax Department for checking the challan status directly. This is accessible for both taxpayers and banks. There are two ways to check the OLTAS Challan Status Online. We will explain both of these steps in detail.

Method 1 – OLTAS Challan Status with CIN Based View

The first method is with the Challan Identification Number (CIN) along with other details. Follow these steps below

- First of all, visit the official website for OLTAS challan status check at https://tin.tin.nsdl.com/oltas/

- Once the home page opens, click on the “CIN Based View” option available under tax payers.

- After this, a new page will appear, here you have to fill in BSR code of the collecting branch, Challan tender date which can be cash or Cheque deposit date, Challan serial number and the amount

- Now, solve the captcha code and then click on the “View” button.

- Finally, you will see the status of the OLTAS challan on your screen.

Method 2 – Challan Status using TAN Based View

The other way to check the OLTAS Challan Status is using the Tax Account Number (TAN)

- First, go to official website of OLTAS Challan at tin.tin.nsdl.com/oltas/

- From the taxpayers section, click on “TAN Based View” option.

- After this, you have to fill Tax deduction/ collection account number (TAN), Challan tender date/ date of deposit (period)

- Now, solve the captcha code and then, click on “View Challan Details“.

- If you want to download this, hit the “Download Challan File” option.

- In the end, the status of the OLTAS Challan will be shown to you.

OLTAS Challan Status for Banks

The Collecting bank branch or nodal bank branch will be able to check their OLTAS challan status. For this, you have follow the below steps

- First, visit the OLTAS status checking page.

- On the home page, you will see the Bank Section.

- From here, select between collecting bank branch or nodal bank branch option to check status.

How to check TIN OLTAS Challan Status Online?

If you are a taxpayer who has paid a direct tax online, you can access the official website of the Income Tax Department’s OLTAS challan. It’s all about checking the status of the challan using the CIN or TAN number.

Process of TIN OLTAS Challan Payment

Follow these steps given below to complete the Process of TIN OLTAS Challan Payment

- First, go to the official website and navigate to the “Services” section.

- Click on the “ePayment” option and then hit “Pay Taxes Online“

- Fill in your challan number in the space provided and then enter the amount to pay to complete the OLTAS challan payment online.

Also Read: HRMS Central Bank of India Login, Cent Swa Darpan at hrms.centralbankofindia.co.in

FAQ’s

What is the official website of OLTAS Challan?

The official website of OLTAS Challan is tin.tin.nsdl.com/oltas/.

How to Check the Status of an OLTAS Challan Refund?

If your payment was deducted and the OLTAS challan refund status was refunded or in progress. The amount will appear in your bank account within 7-14 working days

What should I do if TDS Challan appears in OLTAS now?

If you search for your challan in OLTAS and it does not appear, it means that payment has not been made or that it will be refunded to you.