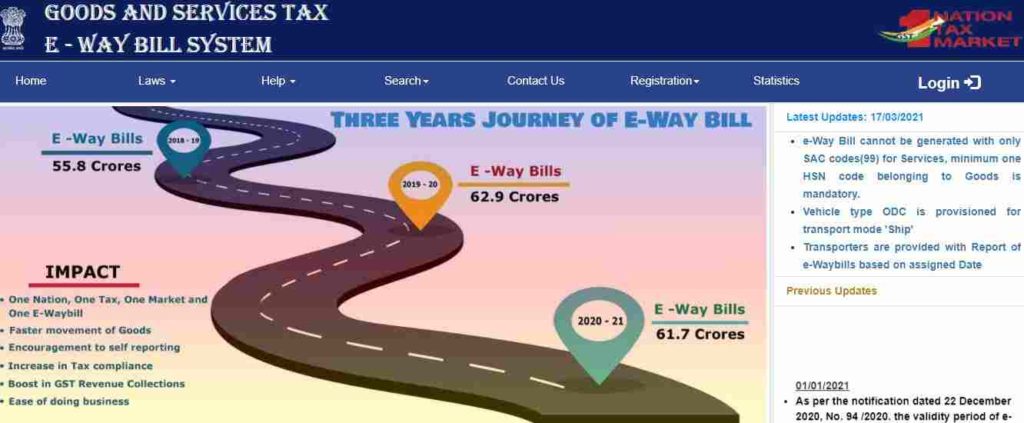

Eway Bill Login | Eway portal guide | Eway Bill Generation Process | https://www.ewaybillgst.gov.in

The GST rules verify that all the transporters has ae-way bill while moving goods from one place to another in the event they satisfy the given conditions. Today here in this article, we will provide you all the information related to Eway Bill Login, Registration process on the EWB portal, how to generate the E-way bill at e-way bill portal and more. So read this article completely.

Table of Contents

What is E-way bill?

E-way bill is meant by Electronic waybill which acts as a unique electronic document that is created to help move one point to the other. This document is generated only if the value of the product is above NR 50,000. THis will apply for both transporter who are moving products either inter-state or intra-state

The e-way bill is a form (Soft copy), which is put back the the waybill manual document provided during the VAT times for moving goods in the country. Now, the government has introduced a web portal in order to help manage all the e-way bills. Users now will be able to cancel the bills by directly visiting the link https://www.ewaybillgst.gov.in/. The link works across the country for all transporters who want to avail an eway bill.

Details of E-way Bill Portal

| Name of the portal | E-way Bill portal |

| Launched by | Government of India |

| Objective | To help product move one point to the other using online slip. |

| Category | Article |

| Official Website | https://www.ewaybillgst.gov.in |

Eway Bill Login

Essentials for e-way bill generation

Here are some of the reason that why to generate an e-way bill

- In order to get an invoice/challan which is related to the goods to transport.

- Registration process to be done on the EWB portal.

- For road transportation, the driver has to submit a transporter id or the vehicle number.

- If transportation will be carried out by rail, air or ship, the transporter must give transporter id, transport proof documents, and correct dates on the papers.

How to generate the E-way bill on the e-way bill portal?

Follow these steps below for generating E-way bill on the e-way bill portal

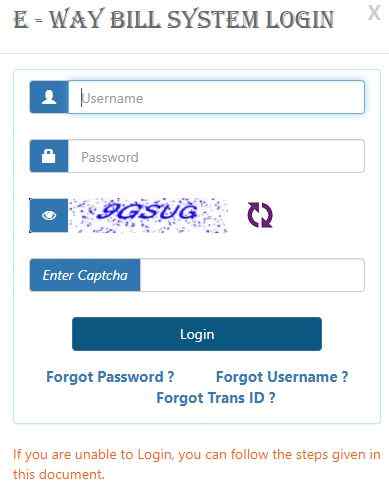

- First of all, you have to go to the official website of e-way bill portal at https://ewaybillgst.gov.in/login.aspx

- Once the home page of the website open, fill in the username and password, followed by the solving the captcha code.

- After this, click on the tab “log in” and then select the “generate new” tab under e-waybill

- Now, you need to enter the details given below

- On the Transaction type page, select the outward option in the event you are the supplier of the consignment.

- Inward if you’re the receipt of the goods.

- Choose Sub-type according to your case.

- Outward transaction

- Inward transaction

- The document type can be a challan, invoice, credit note bill of entry, or others.

- Document number

- Document date

- From or to this depends if you are the supplier or recipient.

- Item details the information is added on the HSN code-wise:

- The product name

- Description

- HSN code

- Quantity

- Unit

- Value

- Tax rates of the CGST and SGST

- Tax rates of cess.

In the transporter details, fill in the transporter’s name, id, and document number. They must also give a mode of transport and vehicle number.

- Once you check all the details entered by you, click the submit button, after which the system will validate the information.

- The e-way bills website portal has several options that users will be able to follow and access information regarding the e-way bills.

Homepage tabs

- Laws

- Help

- Search

- Contact us

- Registration

- Login

By following the above steps, you will be able to use the the portal; after you click on any of the above tab, you will get different services like

- The GSTIN

- All legal names and the type of user

- The notification opens on the same page which has the different information related to the GST portal and E-way bill notices.

- Useful stats which has the number or rejected e-way bills and total generated e-ways and canceled documents.

- The service tab

- Consolidated EWB

- Reject and reports tab.

- Update

- Registration

- Grievances

Also Read: TN EMIS Login App – TNTP School Login Portal at tntp.tnschools.gov.in

We hope, you are provided with all the information related to Eway Bill Login. If you find this article beneficial then show your support by bookmarking our website. Also post your queries related to E-way bill portal at Ewaybillgst.gov.in in the comment.